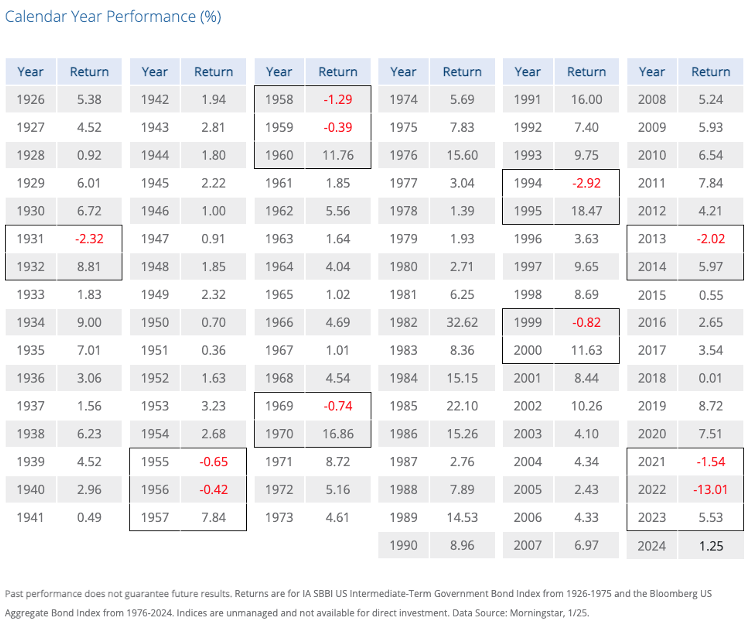

As we’ve recently experienced market volatility, many investors wonder how fixed-income investments hold up in the aftermath of down years. Historically, fixed-income securities, such as bonds, have been considered a safe haven during turbulent times. Yet, understanding how these assets perform after a downturn is crucial for effective portfolio management and financial planning.

The Role of Fixed Income in Investment Portfolios

Fixed income investments play a vital role in diversification. They typically provide a steady income stream and can help mitigate risks associated with equity market fluctuations. In down markets, bonds often become a critical component of a balanced portfolio, offering safety and regular income.

The Impact of Market Downturns on Fixed Income Returns

Interestingly, down years in the stock market do not necessarily have a linear impact on fixed-income returns. While equities may suffer, bonds can react differently based on various factors, including interest rates, credit risk, and economic indicators. During periods of market distress, investors often flock to “safer” investments, driving up bond prices and potentially lowering yields. As a result, fixed-income returns can remain stable or even increase despite adverse equity market conditions.

Historical Trends and Returning Investor Confidence

Historically, fixed-income securities have shown resilience after a significant downturn in the stock market. For instance, during the financial crisis of 2008, while the stock market faced steep losses, high-quality government bonds provided a safety net, resulting in positive returns for bond investors.

Even after downturns, the fixed income market is usually willing to recover. This can be attributed to falling interest rates set by central banks aiming to stimulate the economy. When interest rates decline, existing bonds with higher yields become more valuable, thus boosting returns for bondholders.

Investment Strategies for Navigating Recovery

- Consider Duration and Credit Quality: When investing in fixed income after a down year, it is essential to evaluate the duration and credit quality of bonds. Shorter-duration bonds may shield investors from interest rate fluctuations, while higher-quality bonds offer more stability.

- Diversification: As with equities, diversifying across different bond sectors—including corporate, municipal, and treasury bonds—can help manage risks and enhance returns.

- Monitor Economic Indicators: Economic recovery signals, such as improving GDP or job growth, may influence fixed-income markets. Monitoring these indicators might provide insight into shifting interest rates and bond market performance.

- Stay Committed: Fixed-income strategies require a long-term perspective. Short-term volatility can often mask the fundamental value of fixed-income investments, so it’s essential to remain patient and committed to a well-thought-out strategy.

Fixed Income as a Safe Harbor

In the wake of down years in the market, fixed income investments tend to provide a cushion for investors. While returns may vary, the overall trend historically shows that bonds can remain a reliable source of income and stability. As investors seek to rebuild confidence and navigate recovery, paying attention to fixed income options could be pivotal in fostering a resilient portfolio.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Compliance Tracking # – 696636